utah non food tax rate

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax.

Everything You Need To Know About Restaurant Taxes

State sales tax is 470 percent.

. The Utah UT state sales tax rate is 47. Both food and food ingredients will be taxed at a reduced rate of 175. The Grand County Utah sales tax is 670 consisting of.

In the state of Utah the foods are subject to local taxes. 670 Is this data incorrect Download all Utah sales tax rates by zip code. The restaurant tax applies to all food sales both prepared food and grocery food.

Both food and food ingredients will be taxed at a reduced rate of 175. Lesser is trying to end sales tax on food. Rates include state county and city taxes.

Tax years prior to 2008. TAX DAY IS APRIL 17th - There. UTAH CODE TITLE 59 CHAPTER 12 - SALES USE TAX ACT COMBINED SALES AND USE TAX RATES Tax Rates Subject to Streamline Sales Tax Rules OTHER TAXES APPLY TO CERTAIN.

2020 rates included for use while preparing your income tax. Food and food ingredients taxed at the 3 food rate. Enter sales of electricity heat gas coal fuel oil and other fuels sold for residential use included in line 7.

Residential fuels included in line 7. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer. Utah has state sales.

271 rows 2022 List of Utah Local Sales Tax Rates. However in a bundled transaction which. Local sale tax is collected at county and city levels and it ranges from a low of 125 percent up to a high of 39 percent.

The latest sales tax rates for cities starting with W in Utah UT state. Utah has recent rate changes. January 1 2018 December 31 2021.

Average Sales Tax With Local. January 1 2022 current. 89 rows These rate charts are not intended to be used by non.

However in a bundled transaction which involves both food. Counties and cities can charge an additional local sales tax of up to 24 for a maximum. So the full combined sales tax rates in.

Start filing your tax return now. As of this writing groceries are taxed statewide in Utah at a reduced rate of 3. TAP will total tax due for you.

In the state of Utah the foods are subject to local taxes. Or to break it down further grocery items are taxable in Utah but taxed at a reduced state sales. Date Range Tax Rate.

With local taxes the total sales tax rate is between 6100 and 9050. Utah has a single tax rate for all income levels as follows. Utah Sales Tax Rates By City.

Rosemary Lesser D-Ogden poses for a photo outside of the Capitol in Salt Lake City on Thursday Jan. Detailed Utah state income tax rates and brackets are available on this page. The state sales tax rate in Utah is 4850.

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

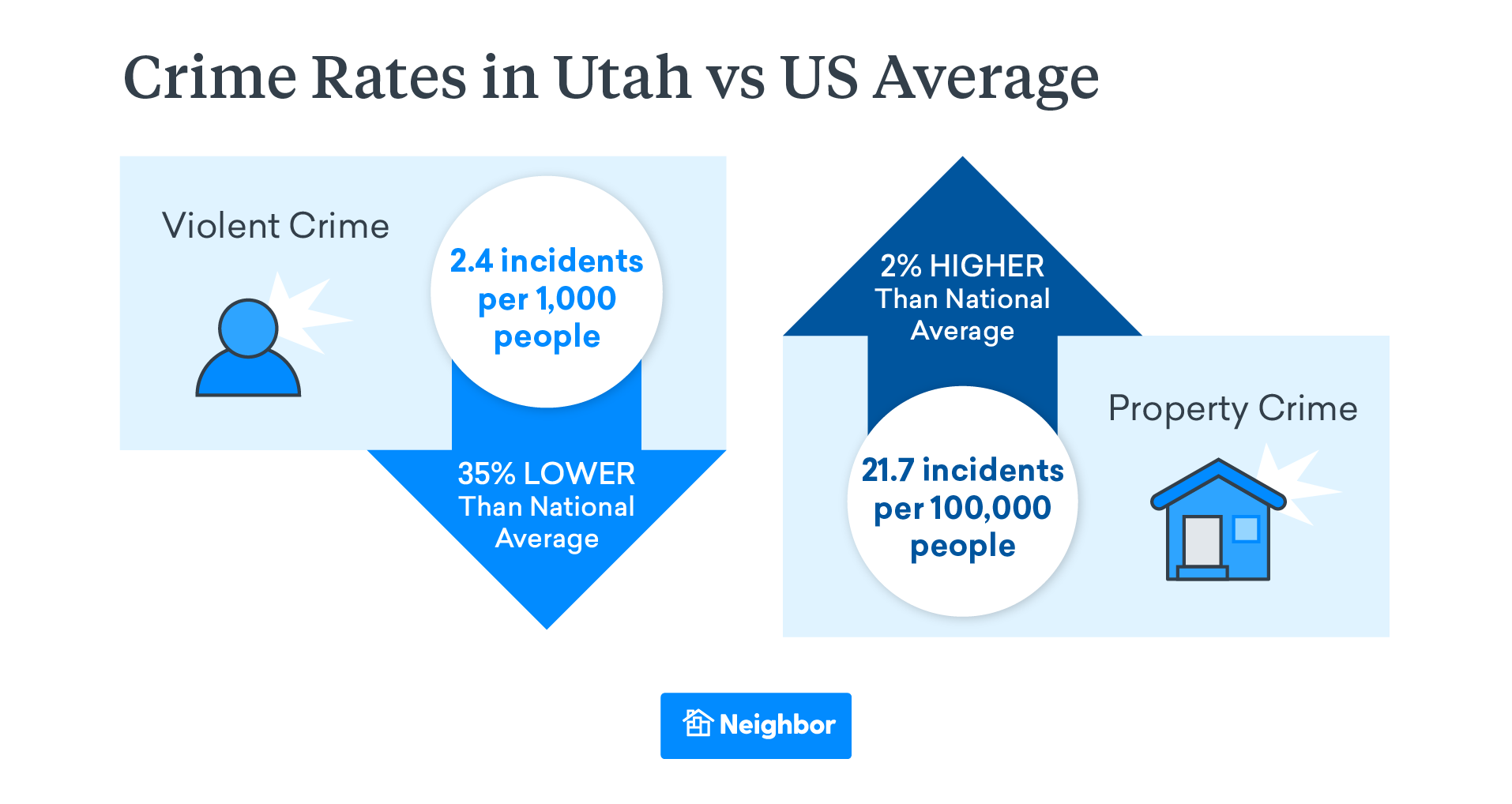

Moving To Utah A Guide To The Beehive State Neighbor Blog

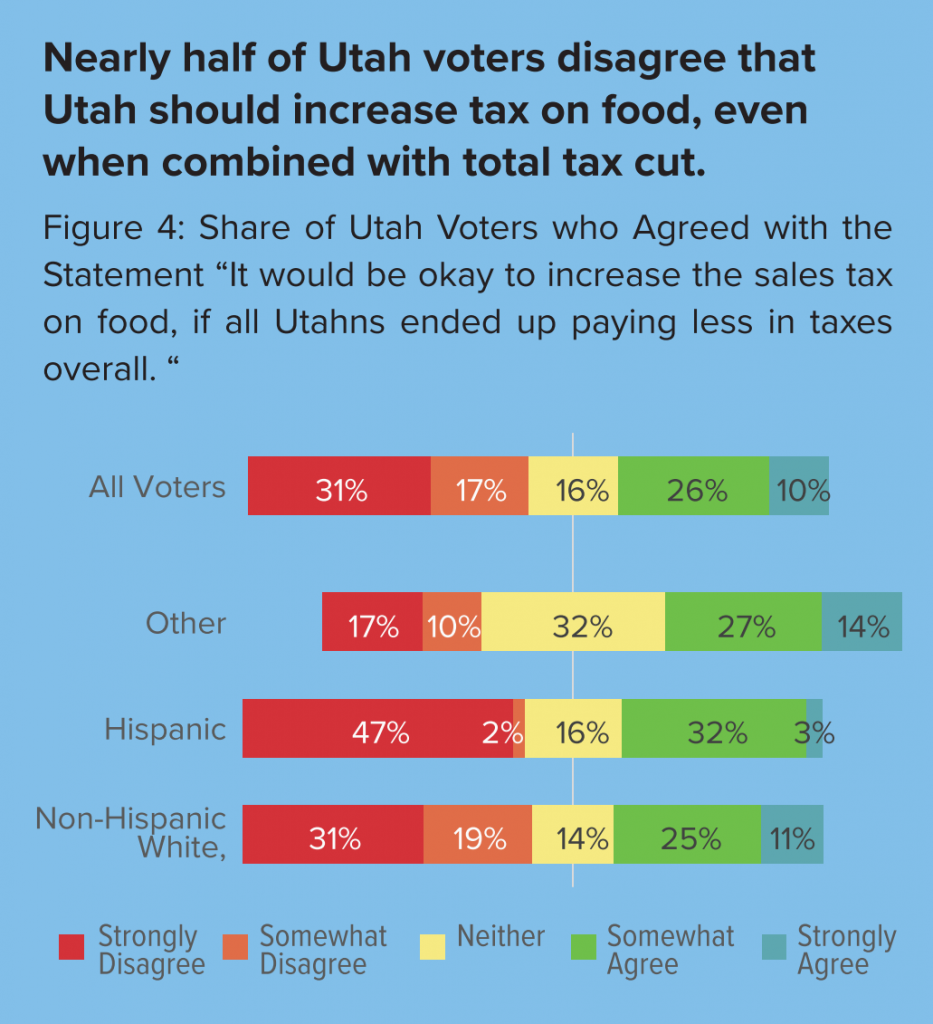

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

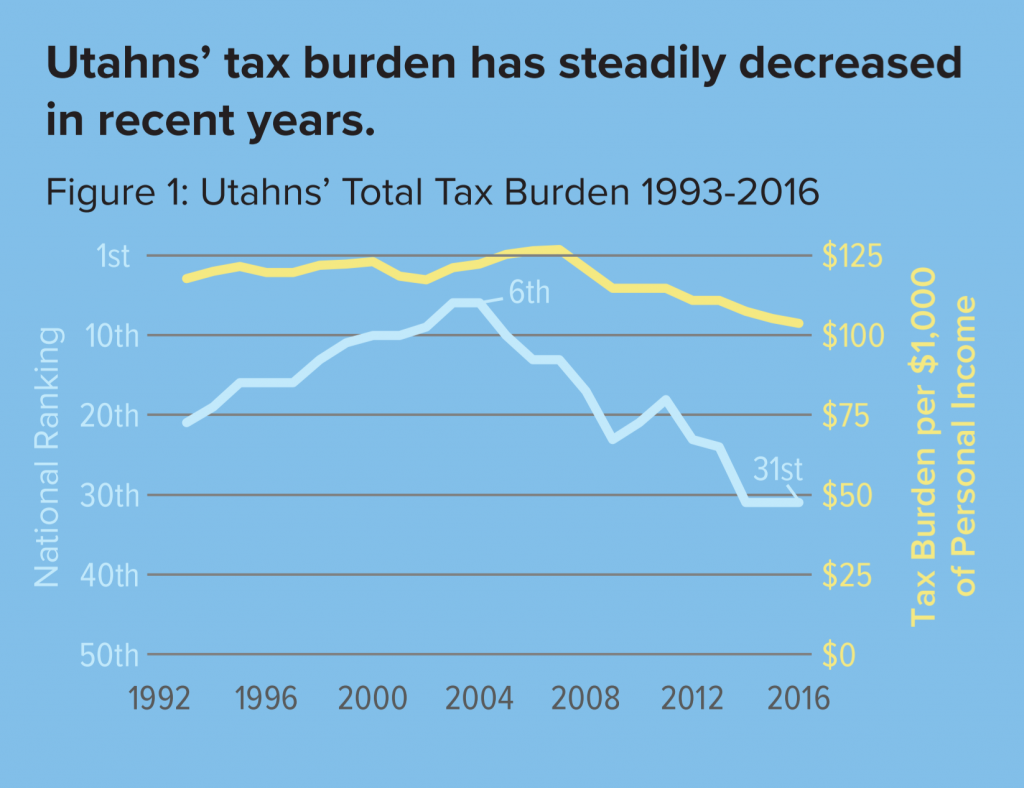

Historical Utah Tax Policy Information Ballotpedia

State And Local Sales Tax Rates Midyear 2019 Tax Foundation

Utah Priorities 2020 Utah Priority No 2 State Taxes And Spending Utah Foundation

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

General Sales Taxes And Gross Receipts Taxes Urban Institute

Moving To Utah A Guide To The Beehive State Neighbor Blog

Utah Sales Tax A Policymakers Guide To Modernizing Utah S Sales Tax

Sales Taxes In The United States Wikipedia

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Home Davis Community Learning Center

Utah Sales Tax Rates By City County 2022

Utah Sales Tax Calculator And Local Rates 2021 Wise